palm beach county business tax receipt search

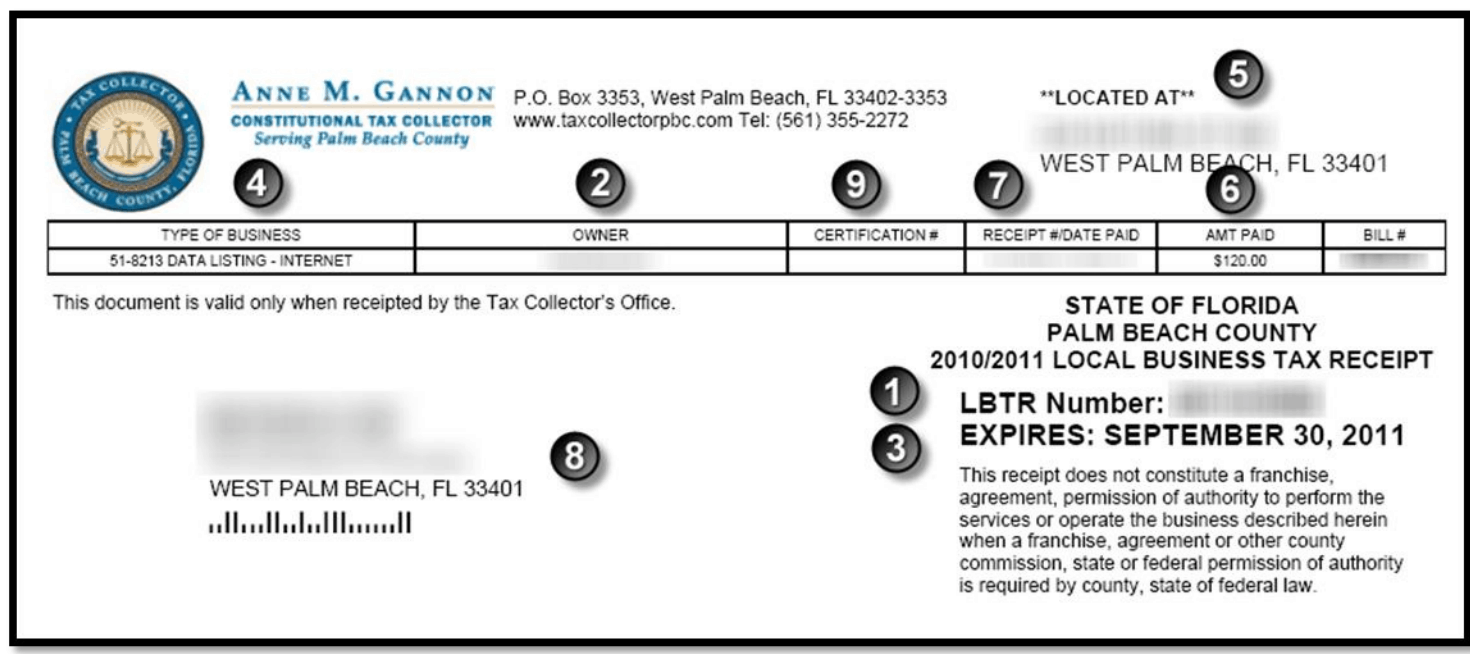

If your business is based within Palm Beach County you must provide a Palm Beach County Wide Business Tax Receipt. West Palm Beach FL 33401.

Business Tax Receipt How To Obtain One In 2022

Anyone who holds a County Wide Business Tax may purchase a Village Business Tax Receipt for a 2 fee.

. Submit your request online. When results are returned click the LBTR Number to view andor pay. The Business Tax Receipt Application is available on our website.

Completed Village of North Palm Beach Business Tax Receipt Application Be sure to answer all of the questions completely including the narrative and notarize the signature Completed Palm Beach County Business Tax Receipt Application Do not go to the County Tax Collectors Office until. As your Constitutional Tax Collector I greatly enjoy visiting the many organizations we have here in Palm Beach County. Toll Free 888-852-7362 Fax.

A separate tax receipt is issued for each use performed within your business and in some cases to each professional operating within your business. You may apply in person for a. Business Address location Business NameTrade Name doing business as -- dba name Click Search.

Form 49 Local Business Tax Fee Exemption Application Note. Completed Palm Beach County Business Tax Receipt Application Do not go to the county tax collectors office until have received Zoning approval from the Village of North Palm Beach Copy of Articles of Incorporation andor Fictitious Name Registration. Submit your request in writing to.

Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us. Whether speaking to a neighborhood coalition or a group from a local Chamber of Commerce one of the rewarding aspects of my job is to meet with citizens and share information about my office and the services we provide. Tax Collector Palm Beach County.

561-712-6600 Boca Delray Glades. These documents and forms may be reproduced upon requrest in an alternative format by contacting the Palm Beach County Tax Collectors ADA Coordinator 561-355-1608 Florida Relay 711 or by completing our accessibility feedback form. Royal Palm Beach FL 33411.

There may be other requirements in order to issue your business tax receipt. For businesses with locations outside of the City of Palm Coast a Local Business Tax Receipt may be required. Citizens and business owners can search for Business Tax Receipts renew Business Tax Receipts and submit payment for those renewals and also l see the cost of obtaining a Business Tax Receipt to do business in the Village of Royal Palm Beach.

Applying for a Business Tax Receipt. Please note that if you are opening a new business and need a new Business Tax Receipt you will need to come to the. Proof of Palm Beach County TDT account.

Your Search for Real Updated Property Records Just Got Easier. These fees are for the most common type of applications. 50 South Military Trail Suite 201 West Palm Beach FL 33415 West Palm Beach Area.

Ad Property Taxes Info. Commercial locations must submit the following. Allow 7 to 10 business.

For specific businesses or if you are unsure please call 561-799-4216 for fee estimates. You can renew your Palm Beach County Business Tax Receipt do not have a Palm Beach County Business Tax Receipt please contact the Palm Beach County Tax Collector at 561-355-2264. The City of West Palm Beach Business Tax classifications and rate schedule can be found in Section 82-163 of our municode.

All other applicants will pay full fee cost. County Business Tax Receipt Application. If your business has more than one location a separate tax receipt is required for each location.

Serving Palm Beach CountyPO. 301 North Olive Avenue 3rd Floor Legal Services. Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an additional penalty of 2500.

Just Enter an Address. To help determine if a Local Business. Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us.

If you are looking for additional information about Drivers License Renewals Auto Tag Renewals andor Registrations Handicap Permits HuntingFishing Licenses or any other County Tax related business OTHER THAN registering for a Business Tax Receipt please call 561 355-2264. A business performing a service in Palm Coast will need to present a copy of their current Business Tax Receipt from the CityCounty their business is located in order to obtain a City of Palm Coast Local Business Tax Receipt. County Business Tax Receipt Search.

Business Owner Enter by Last Name First Name LBTR Number Local Business Tax Receipt Mailing Address. Copy of DBPR state license. The fees vary depending on nature of business.

Box 3353West Palm Beach FL 33402-3353.

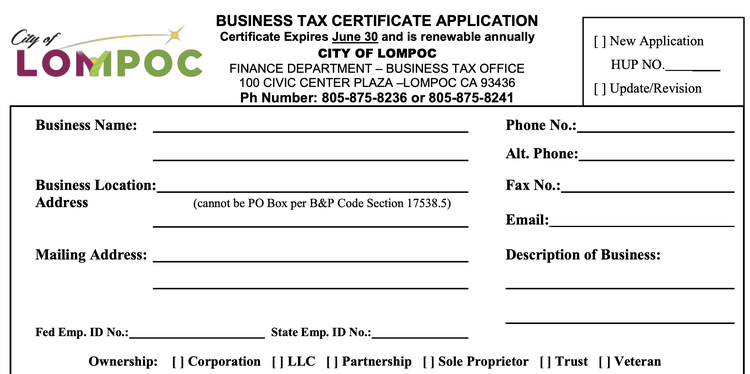

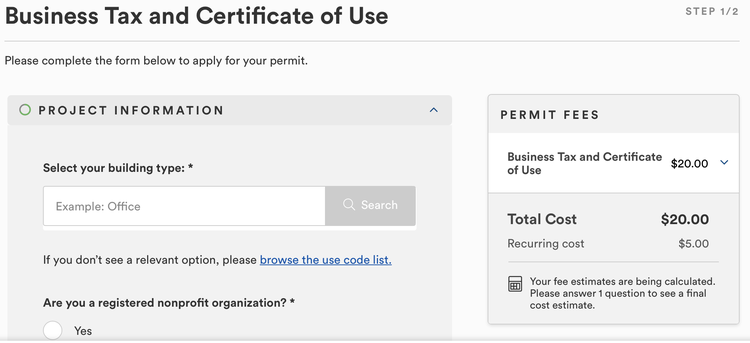

Business Tax Receipt How To Obtain One In 2022

Business Tax Receipt How To Obtain One In 2022

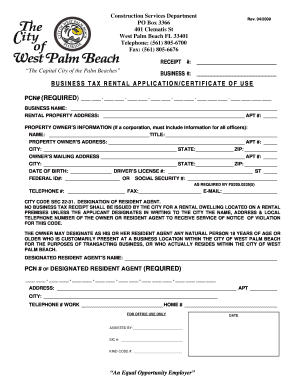

Business Tax Rental Application Certificate Of Use City Of West Palm Web Fill Out And Sign Printable Pdf Template Signnow

Fill Free Fillable Constitutional Tax Collector Pdf Forms

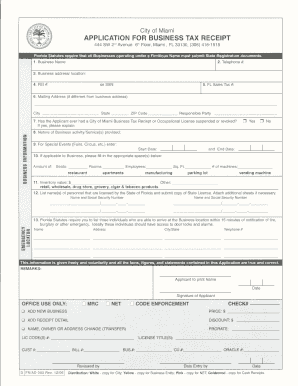

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Fill Free Fillable Constitutional Tax Collector Pdf Forms

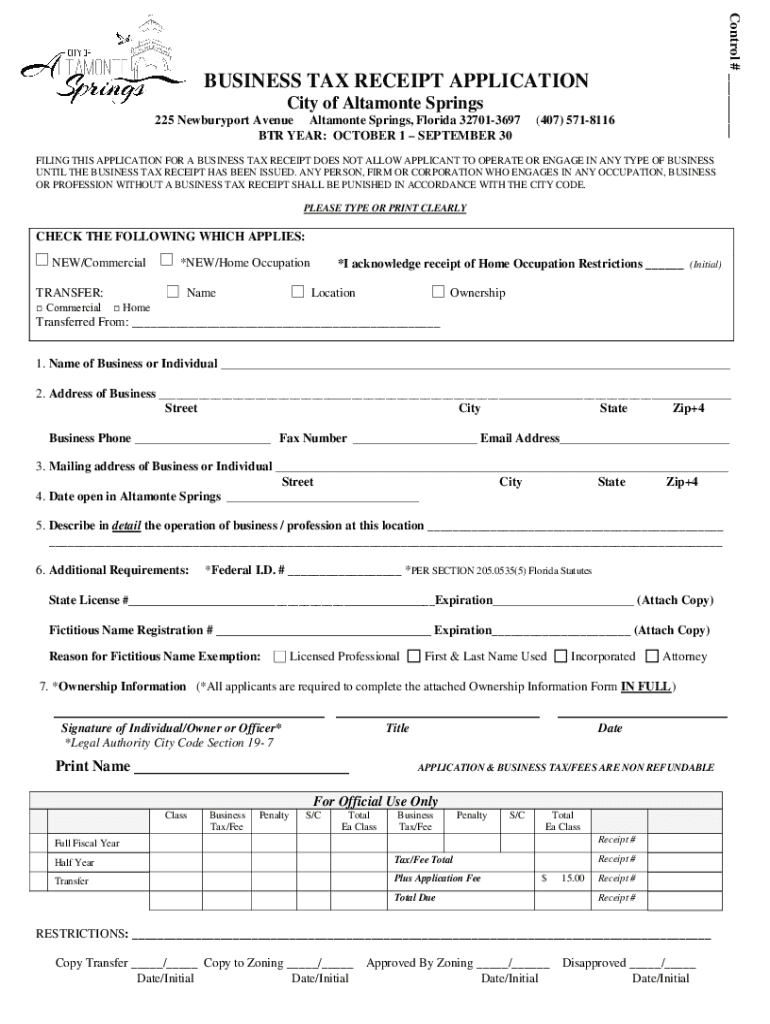

Fl Business Tax Receipt Application Fill Out Tax Template Online Us Legal Forms

Local Business Tax Constitutional Tax Collector

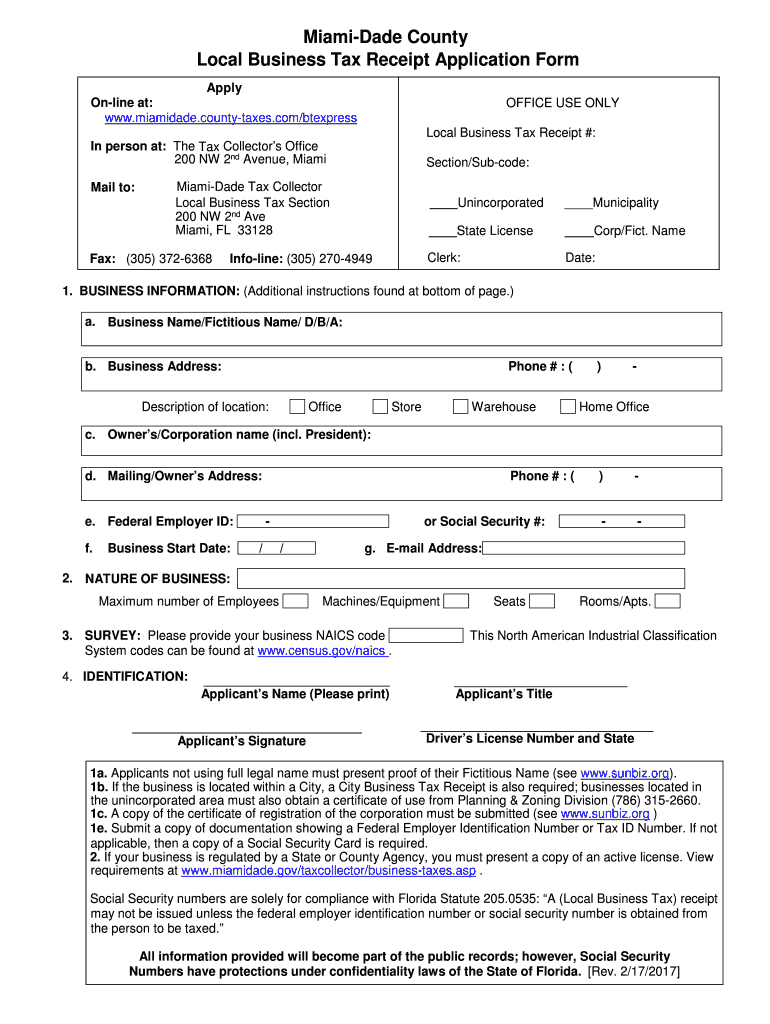

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

Local And County Tax Receipt Laws In Palm Beach County

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Lauderhill Area Broward County Local Business Tax Receipt 305 300 0364